AEI-Insights - AN INTERNATIONAL JOURNAL OF ASIA-EUROPE RELATIONS

(ISSN: 2289-800X); JANUARY, 2015; Volume 1, Number 1

Fumitaka Furuoka

Visiting Senior Research Fellow

Asia-Europe Institute

University of Malaya

50603 Kuala Lumpur, Malaysia

Tel: 603-7967-6902, Fax: 603-7954-0799

Email: fumitaka@um.edu.my

The rise of China is one of most spectacular events in the global economic and political landscape. More importantly, it can be seen as an emerging of the China-led East Asian regional integration. This paper employs the “flying geese” theory to examine the unique characteristics of emerging new regional integration in East Asia. In this new East Asian regionalism, the Chinese currency is said to become the “key currency” in the region. Thus, this study used several statistical methods to examine the role of Chinese currency in the regional integration. The empirical analysis detected a stable and long-run co-movement between the Chinese Yuan and the Japanese Yen. As a conclusion, the Chinese Yuan has started playing a role of de facto key currency to influence the movement of other regional currencies. These findings could be interpreted as the new pattern of the East Asian regionalism in which the regional momentary and financial coordination would become a main economic policy agenda.

Regional integration, China, East Asia, flying geese theory, key currency

Note: The author is grateful to Professor Jozef Batora and Professor Werner Pascha for their constructive comments and suggestions that helped to improve the quality of this article. The original manuscript was presented in the International Conference on “China, ASEAN and the Changing Context of East Asian Regionalist”, December 5-6, 2012. The conference was jointly organized by Xiamen University (China), Changwon National University (South Korea), and University of Malaya (Malaysia), with special sponsorship from the Japan Foundation. The author is grateful about comments and constructive criticism from the participants of the conference.

The rise of China can be seen as the one of most spectacular historical event in the international economic and political landscape and the global impact of China’s economic might has the potential to be enormous (Jerden & Hagstrom, 2012). In the context of the East Asian regionalism, the rise of China can be interpreted as the change of leading economy in East Asia, from Japan to China. Since the end of the 1970s, China has emerged as the “world’s factory” due to its successful and effective implementation of numerous economic and modernization policies. By contrast, Japan suffered serious economic downturn which was commonly known as the “lost decades” since the 1990s. In other words, the rise of China can be interpreted as an emerging of the China-led East Asian regionalism.

Moreover, a unique characteristic of the East Asian regional integration, in comparison with other prominent regional integrations, such as the European Union (EU), is its relatively hierarchical structure. The EU’s relatively horizontal structure could be seen as a socio-cultural reflection of the independent and individualistic orientation in the region. By contrast, the relatively hierarchical structure in the East Asian economic integration could stem from Asia’s collective orientation by nature. This is the very reason why there is a need to employ an appropriate theoretical framework to examine the historical evolution of the East Asian regional integration.

Thus, this paper employs the “flying geese” model developed by Kaname Akamatsu to analyse the East Asian regional integration (Akamatsu, 1935).1 The flying geese model is essentially an economic development theory to describe how the “latecomer” would catch up with more advanced economies by growing through stages of economic development, unleashing the power of trades and investments and transforming itself from an “import-substitution” country to an “export-oriented” one by upgrading their technological capacities and innovation mechanism. However, at same time, the flying geese theory can be applied to examine a historical pattern of the hierarchical, rather than horizontal, regional integration.

In other words, the Akamatsu model seems to provide a more promising analytical perspective to capture a historical pattern of the hierarchical integration in the region. 2 This is mainly because the flying geese model is able to take account of fundamental dynamics and diversity in regional integration in East Asia that covers countries with different stages of economic development. In the region, there are dynamic interactions and interdependencies among countries with three different stages of development, namely, the advanced industrial economies, the rapidly growing developing economies and the least developed economies. First of all, some East Asian economies have reached the most advanced stage of economic development. Among them are Singapore, South Korea, Taiwan and Japan. Secondly, there are other successful developing countries which have maintained relatively steady economic growth with political stabilities. Among them are Indonesia, China, Malaysia and Thailand. Finally, there are a few remaining least-developed East Asian countries that have suffered from low economic growth and political instabilities. Among them are Myanmar, Laos and Cambodia.

More importantly, the rise of China seems to signify the emerging pattern of new regional integration or the China-led East Asian regional integration. Despite some similarities between previous attempts for the regional integrations and this new regionalism, the most striking difference and interesting feature is the role of currency in the new regional integration. As financial sector’s increasing dominance in the regional business and economic transaction, the leading economy is expected to stimulate the regional economic development through not only the international transaction of goods and services, but also the international monetary transaction. There is little doubt that there has been a close linkage between the regional economic integration and financial coordination in any regionalism. However, the role of currency can be seen as a key factor in the regional integration in East Asia only during the formation of this new regionalism. During the periods of the previous regional regionalisms, the banking and financial sectors had become underdeveloped in the region. In those days, international monetary transaction was a peripheral business activity while banking and financial institutions in the region had normally focused on the domestic retail banking transaction or additional supporting jobs to assist existing customer’s activities in foreign countries. More recently, many Asian banking institutions grew up to become the multinational banking corporations which have conducted numerous banking services across national boundaries and have operated branches all over the region. With this increasing importance of international finance, the leading economy is expected to play an important role to create and stabilize the regional financial system. In this context, the Chinese currency is set to become the “key currency” in the new East Asia regionalism.

Thus, this paper used several statistical methods to examine whether the Chinese currency has played the role of “key currency” in the new East Asian regionalism. The findings from this empirical research would have important policy implication for economic integration around the world. There are two types of approaches to set up the key currency in regional integration. The first approach is that member countries would have normal discussions to choose and create a new currency for the regional key currency. The most prominent example is the Euro’s role in the European Union. Despite the fact of the Deutsche Mark’s relatively dominant position in the economic transaction in the EU, the member countries decided to introduce the new currency – the Euro – as the official currency for the European Monetary Union (EMU). The second approach is that member countries would select a dominant currency as the “key currency” or the “reference currency” in order to stabilize their own currency. A prominent example of the second approach is the Chinese Yuan’s role in the regional integration in East Asia. Without any formal discussion or signing any treaties, the Chinese currency seems to have emerged as the de facto “reference currency” in the region. If the Chinese currency would successfully play a role of the key currency in the region, this could encourage political leaders and central bankers in other economic groupings to adopt the “Chinese” approach, rather than the “European” approach which has come under strong criticism since the European sovereign debt crisis.

Following the introductory section, Section two will examine the historical pattern of regional integration in East Asia before the rise of China. The next section will analyze the new pattern of regional integration or the China-led East Asian regional. Section four will examine empirically whether the Chinese Yuan can play a role of the key currency in the region. The final section is the conclusion.

The “flying geese” theory was introduced by a well-known Japanese economist, Kaname Akamatsu, in the middle of the 1930s. Akamatsu aimed to use the multi-tier hierarchical pattern or the “flying geese” pattern of regional integration to capture the dynamic process of regionalism in which industrialization in relatively developed countries would inevitably spread to the relatively less-developed countries (Akamatsu, 1935). In his “flying geese” theory, Akamatsu’s main intension is merely to describe how Japan, the latecomer in East Asia, is able to catch up with the more advanced economies in the West, such as United States, United Kingdom and France. Yet, this theoretical framework of economic development can be used to examine some unique characteristics of regional integration in East Asia.

In the “flying geese” theory of regional integration, there is the multi-tier structure, namely the “leading developed economy”, the “second-tier developing economy” and the “third-tier least-developed economy”. In this structure, the “leading” economy would lead the “second-tier” developing countries. In turn, the “second-tier” economies would play a role to lead the “third-tier” least-developed countries. In this sense, the most interesting characteristics of this regional integration are its hierarchical patterns. In other word, countries in this regional arrangement are not equal partners. Instead, there is a dominant country and its followers. It implies that there is a patron-client relationship between dominant developed country and minor developing countries. Before the rise of China, Japan was a leading economy in the region. The “flying geese” pattern of the East Asian regional integration may offer some explanation for Japan’s arrogant insistence to lead the regionalism in East Asia. Pempel (1996/1997) criticised Japan’s arrogance and asserted that Japan’s permanent place never seemed to have been challenged.

From a historical point of view, there were three attempts to form the “flying geese” pattern of regional integration in East Asia. The first formation of the “flying geese” is Japan’s cruel and failed attempt to form the gaggle of the “flying geese” before the end of World War II. Then, the second formation is another of Japan’s unsuccessful attempt to establish a regional production network after the war. More recently, China has become the global economic powerhouse and the emergence of this new dominant power in the region can be seen as the formation of the third gaggle of the “flying geese”.

In its first attempt, Japan forcefully integrated East Asia by using brutal and cruel military forces. Before and during the war, Japanese military government implemented harmful expansionist and colonialist policies to form a Japan-led regional integration under the “Greater East Asia Co-Prosperity Sphere”. Before Word War II, as the “leading economy” in the region, Japan colonized Taiwan, Korea and Manchuria. These countries were considered as the “second-tier countries” in this regional integration. Then, Japan used military forces to invade the other part of East Asia during the war. These occupied countries were seen as the “third-tier countries”. Under the first “flying geese” pattern of East Asian regionalism, Japan brutally and cruelly suppressed the peoples in East Asia.3

The first attempt to form the “flying geese” pattern of the East Asian region ceased to exist in 1945 when the Japanese military junta unconditionally surrendered to the United States and its allies. As a consequence, Japan lost its all former colonies and occupied countries in East Asia. Instead, Japan was occupied by the United States under the leadership of General Douglas MacArthur during the period of 1945-1952. During World War II, the leading country cruelly and brutally inflicted serious damages on its follower countries. In the end, it also suffered from total devastation and destruction that was brought foolishly upon itself. Yet, a fact seems to remain that Japan’s totally failed expansion policy can be seen as the first attempt to form a regional integration in East Asia. Pempel (1996/1997) comments that the first bid for Asian integration came with the Japanese military junta’s attempt to create the “co-prosperity sphere” in East Asia.

After World War II, Japan used economic force to create the second Japan-led regional integration in East Asia. In this second attempt, Japan made efforts to establish a production network in the region. Dajin Peng observed that the Japan-led production network in East Asia can be seen as an informal economic integration and this regional integration involves no agreements or specific institutional mechanism. Instead, this regional integration is based on the transnational business logic (Peng, 2000).

In the initial stage of this second “flying geese” in East Asia, as the leading economy, Japan successfully exported numerous manufactured goods to neighbouring Asian countries and other countries in the world in the first stage of regional integration. During this stage, some developing countries in East Asia successfully implemented industrial policies and achieved high economic growth. These countries are known as the newly industrializing economies (NIEs) and among them are Hong Kong, Singapore, South Korea and Taiwan. These countries can be seen as the “second-tier” countries in this regionalism. The leading economy established production bases in these countries through foreign direct investment (FDI). In the next stage of the regional integration, these second-tier economies successfully produced competitive products. These countries would export their manufactured goods to other Asian countries and other parts of world. In the third stage, second-tier countries themselves used FDI to establish their production bases in least-developed countries (i.e. third-tier countries) in the region. In turn, these third-tier countries also successfully industrialized their economies and started exporting their production. Among them are Indonesia, China, Malaysia and Thailand. World Bank praised them as the “East Asian miracle” economies in the beginning of the 1990s (World Bank, 1993).

In this second round of regional integration, Japan adopted the mercantilist policy to establish economic hegemony in the region by using international trades, foreign investment and economic assistance. Saravanamuttu (1988) asserted that the patterns of trades, investments, and aid between Japan and other Asian countries clearly revealed Japan’s strategy of economic penetration in East Asia. He commented that Japan tried to create economic dependence in Asian countries on Japan and to establish economic hegemony in the region. It should be noted that the Japanese government used foreign aid as an important tool to establish the Japan-led economic integration in East Asia. After the war, Japan needed to pay war reparation to East Asian countries since the 1950s. However, Miyashita (1999) argued that Japan used the war reparation payment to re-establish economic ties with countries under the “co-prosperity sphere”. Since the 1960s, Japan became a major provider of foreign aid to East Asian countries. Yet, Katada (2002) claimed that the main objective of Japanese aid was not humanitarian consideration and Japan used the foreign aid to create the production network in the region.

Despite Japan’s suffering from serious economic recession beginning around the end of the 1980s, the Japan-led production network has functioned well until 1997 when the Asian financial crisis broke out in Thailand and spread through other countries in the region. This meant that the sudden bust of the “East Asian Miracle” seemed to signify the end of the second formation of the “flying geese”. Tay (2002) argued that the Asian financial crisis has scattered the flock of flying geese that followed the Japanese way of economic development.

The rise of China has significantly modified the pattern of East Asian regional integration. It signifies the change in the dominant economy in the region, from the declining Japan to the rising China. The emergence of China as a global superpower could be interpreted as the beginning of the third flying geese. In this third gaggle of the flying geese, China is emerging as the leading economy, followed by the “second-tier” economies (South Korea, Singapore, Taiwan and Japan) and the “third-tier” developing countries (other developing countries in the region). As Ahn commented, with China’s increasing importance in the region, the overall direction of economic interdependence is shifted from the Japan-centred production network to the China centred one. China is emerging as the regional hub of international trade and investment as well as the centre of the regional production network. More interestingly, China is emerging as the centre of the inter-industry and vertical economic integration in East Asia (Ahn, 2004).

In other words, the rise of China could be interpreted as an emergence of new “triangle trade” relations in East Asia. As Richard Baldwin pointed out, there were the Japan-centred “triangle trade” relations in which Japan would produce some high tech goods and materials and export them to ASEAN countries, such as Malaysia, Thailand and Indonesia to assemble them to produce the final produce. These ASEAN countries would re-export the final products to the developed countries in North America or Europe (Baldwin, 2008).

However, the China’s integration into a global economy since the beginning of the 1990s has drastically transformed the business landscape in the region into a new form. Ahn pointed out that China has started playing a dominant position in the new triangular relationship of trade interdependence and business transaction in the region. In this new “triangle trade” relations, China would import intermediate high-tech goods from developed economies in the region, such as South Korea, Taiwan and Japan as well as some other materials and low-tech parts from the developing economies in the region, such as Malaysia, Thailand, and Vietnam. After these countries would assemble them and produce final products, China would re-export them to wealthy countries around the world (Ahn, 2004).

On the other hand, the rise of China may affect the role of the United States in the region. Before the rise of China, Japan was the only economic superpower in East Asia and the country had played a quasi-hegemonic role in East Asia during the flights of the first and second “flying geese”. The situation is metaphorically described by T.J. Pempel (1996/1997) as the “Gulliver (Japan) in Lilliput (East Asian economies)”. In this context, East Asian countries welcomed US involvement in the region as a balancing role to check Japan’s regional ambition (Beeson, 2001). Despite its economic strength in the global economy, Japan never repeated the same mistake as before the war and upheld and supported the international order that was created and maintained by the West. By contrast, according to Ikenberry (2008), some researchers have showed concerned about China’s hegemonic role in Asia and its ambition to reshape the international order to serve its national interest. They predicted that there could be an intense rivalry and possible conflict between the “rising hegemon” (China) and the “declining hegemon” (United States) in Asia. In this scenario, there is a possibility that the new regional integration could pose a threat to the existing international security system. Mearsheimer warned that, as China’s economy would continue to grow, China would try to dominate Asia by maximising the power gap between China and other neighbouring countries while the United States would maintain its hegemonic power over the Western hemisphere. In the end, China and United States would engaging intense security competition (Mearsheimer, 2006).

It should be noted that unity in the previous formations of the “flying geese” pattern of regional integration was maintained through the usage of power. The military power was forcefully used before and during the war. After the war, economic power was used to establish the production network in the region. In the China-led regional integration, another power, international financial power, would play a significant role for the establishment of the regional integration. In other words, the important role of Chinese currency in the East Asian regionalism is a new and unique characteristic of the third flying geese. During Akamatsu’s lifetime, the international finance in the region, especially international monetary transactions between East Asian economies, were still underdeveloped. Akamatsu witnessed the successful performances of the Asian Newly Industrializing Economies and the second “flying geese” and he is able to modify and deepen his theory to fit the economic reality of East Asia at that time. Unfortunately, he was unable to live long enough to witness the rise of China and increasing importance of the international financial transactions in the region to modify his “flying geese” theory that is based on regional movement of trades and investment.

The role of the Chinese Yuan as a key currency drew international media attention. The leading economic newspaper, The Economist, published an interesting and thought provoking article entitled “The Rise of Yuan”. The newspaper argued that the Chinese Yuan seems to take over the role of the “key currency” in the Asia after the European currency crisis in the end of the 2000s. There are several Asian currencies which indicated a high degree of co-movement with the Chinese currency (The Economist, October 20, 2012). It means, without conducting any formal discussion or signing any treaties, the Chinese currency seems to be emerging as a de facto “key currency” in the region. In other words, the leading economy in the third flying geese would lead other countries in the region through not only international trade and investment, but also international monetary transactions. If the Chinese Yuan would play an important role in regional economic integration, this fact could encourage political leaders and central bankers in other economic groupings to adopt a pragmatic and informal “Chinese” approach, rather than the treaty-based and formal “European” approach.

Can the Chinese Yuan be the key currency in the region?

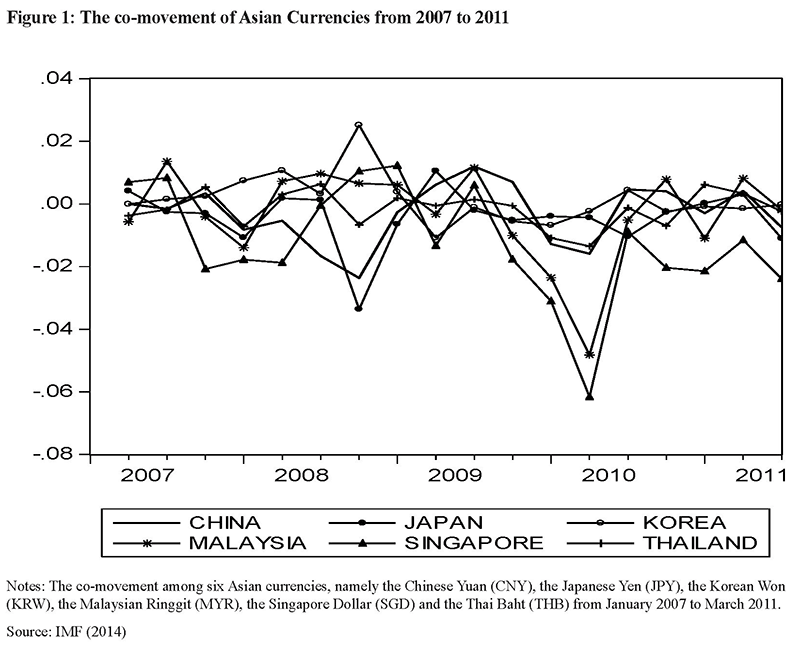

This section empirically examines the role of Chinese currency in China-led economic integration in East Asian. In other words, it would analyze whether the Chinese currency could play a role of regional “key currency” in the East Asia. It used the co-movement of the Chinese Yuan (CNY or Renminbi) with major East Asian currencies, such as the Japanese Yen (JPY), the Korean Won (KRW), the Malaysian Ringgit (MYR), the Singapore Dollar (SGD) and the Thai Baht (THB) as a proxy to capture China’s leadership role in the region. In other words, the higher degree of co-movement between the CNY and other East Asian currencies can be seen as an empirical proof that the Chinese Yuan would play a leading role of the “key currency” in the international monetary regime in East Asia.

This paper used the national currency per the Special Drawing Rights (SDRs) from January 2007 to March 2011 to measure the movements of the exchange rates in the Asian countries after the European currency crisis.4 The main source of data is the International Financial Statistics (IFS) from the International Monetary Fund (IMF, 2014).The data were transformed into logarithms. The co-movements between Chinese Yuan and the other East Asian currencies are shown in Figure 1. This paper used the following statistical methods to examine the possibility of the third flying geese in East Asia, 1) correlation analysis, 2) unit root analysis, 3) cointegration analysis and 4) causality analysis.

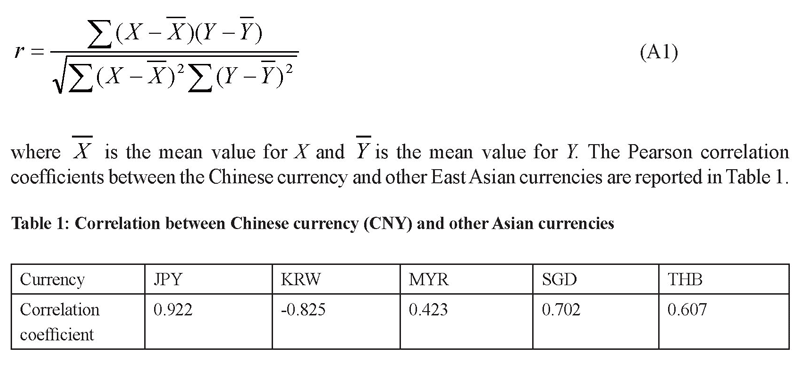

Firstly, the Pearson correlation analysis is used to measure the dependency between Chinese currency (CNY) and other Asian currencies. Empirical findings from correlation analysis are reported in Table 1. The findings clearly indicate that the Chinese currency has a strong relationship with other Asian currencies, except Korean currency. There is an especially strong relationship between Chinese currency and three Asian currencies, namely the Japanese Yen (JPY), the Singapore Dollar (SGD) and Thai Baht (THB).5

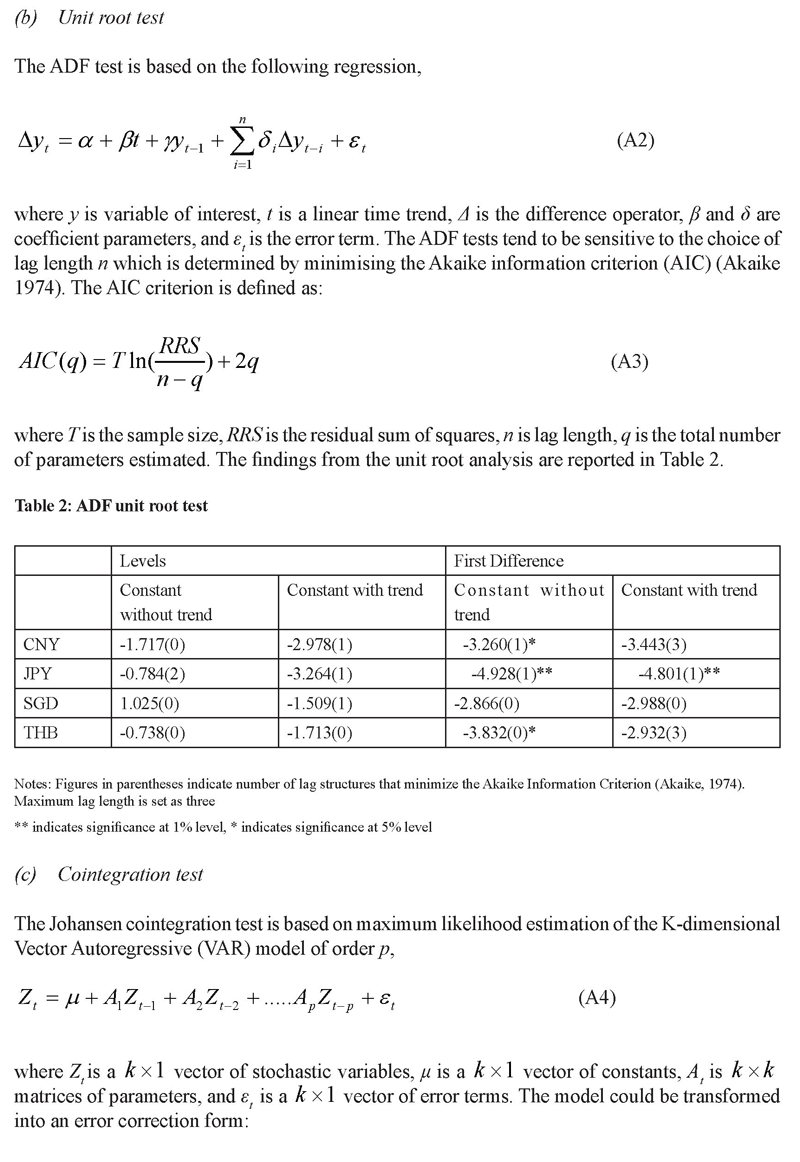

Secondly, unit root test is used to examine the stationarity of data sets. If there are co-movements between two variables, the order of integration between variables should be the same. This paper uses the augmented Dickey-Fuller (ADF) unit root test to investigate the stationarity (Dickey & Fuller, 1979) of four currencies time series, namely, the Chinese Yuan, the Japanese Yen, the Singapore Dollar (SGD) and Thai Baht (THB). The Korean Won and the Malaysian Ringgit are excluded from analysis because these currencies do not seem to have strong positive association with Chinese currency. The empirical findings from unit root tests are reported in Table 2. The findings clearly indicate that all four currencies, except the Singapore Dollar (SGD) are integrated of order one or I(1). This means that these three currencies, namely, the Chinese Yuan, the Japanese Yen (JPY) and the Thai Baht (THB) have the same order of integration. The Singapore Dollar should be excluded from further analysis due to the fact that the currency did not seem to be integrated of order one.

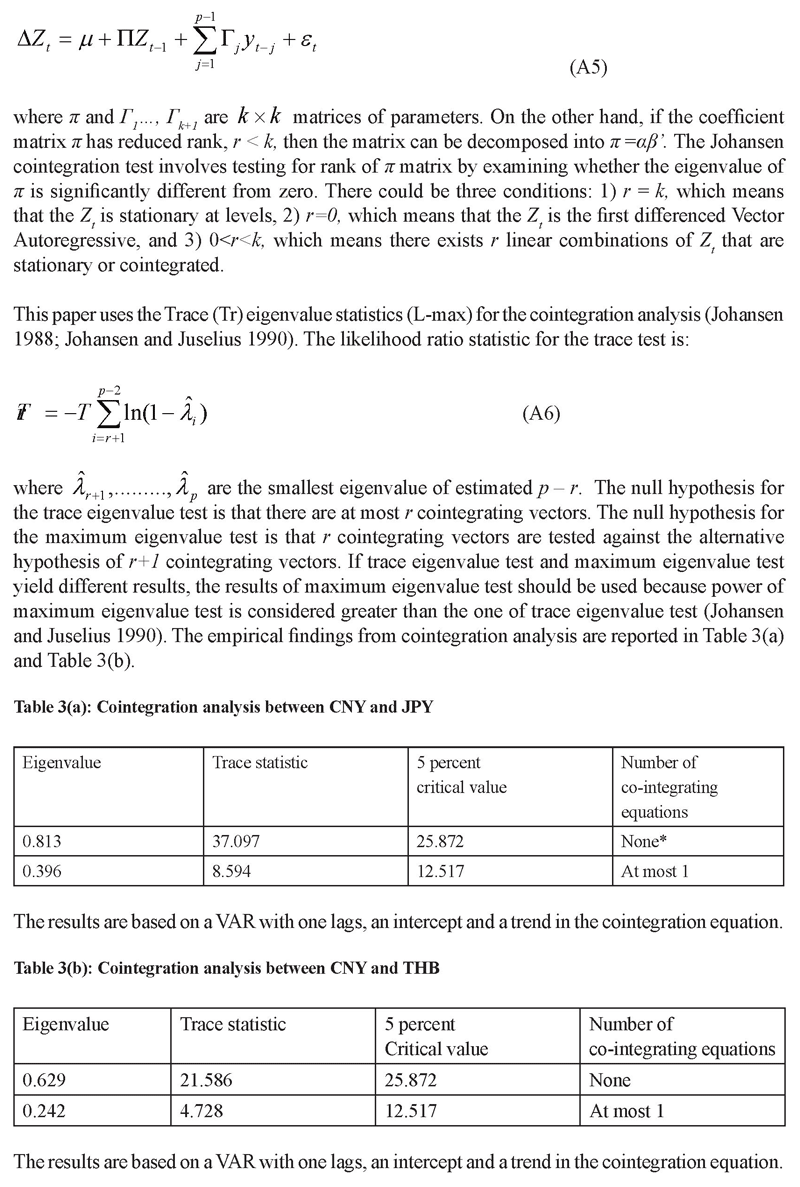

Thirdly, the Johansen cointegration test is used to examine the long-run cointegration relations or co-movement between three Asian currencies, namely, the Chinese Yuan, the Japanese Yen (JPY) and the Thai Baht (THB). The empirical findings from the cointegration analysis are reported in Table 3(a) and Table 3(b).

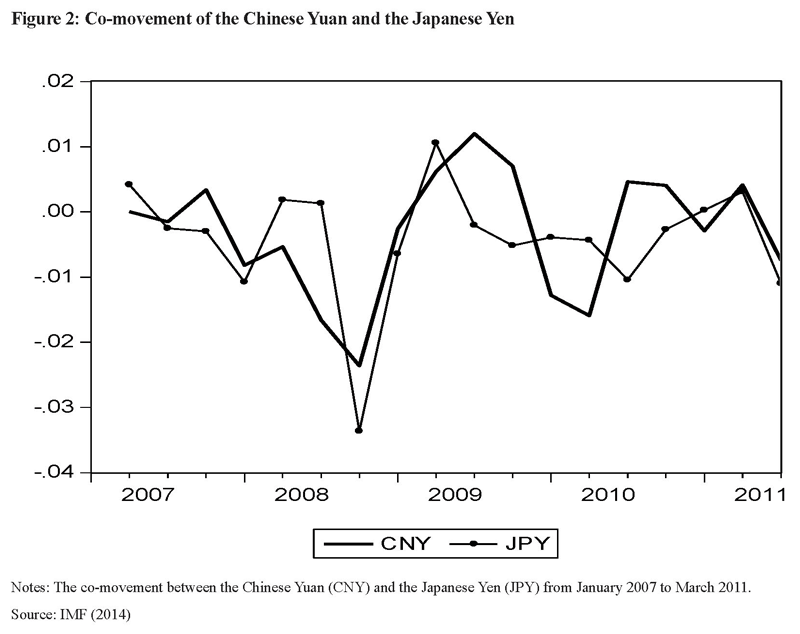

According to findings from the Johansen cointegration analysis, there is a long-run cointegration relation between the Chinese Yuan (CNY) and the Japanese Yen (JPY). In other words, there are strong association and co-movement between the Chinese Yuan and the Japanese Yen in the long-run. On the other hand, findings indicate that there is no cointegration relation between the Chinese Yuan (CNY) and the Thai Baht (THB). In other words, empirical finding does not seem to indicate the co-movement between the Chinese Yuan and the Thai Baht. The co-movement between the Chinese Yuan (CNY) and the Japanese Yen (JPY) could be expressed as:

lnCNY = 1.060 lnJPY + 0.016 Trend

This co-movement equation or the cointegrating vector equation indicates that there exists a positive long-run relationship between the Chinese Yuan and the Japanese Yen. This equation can be seen as another empirical proof for the co-movement between the CNY and JPY. In other words, the Chinese currency could also appreciate against the SDRs if Japanese currency would appreciate against the SDRs. The highly correlated co-movement between the Chinese Yuan and the Japanese Yen is shown in Figure 2.

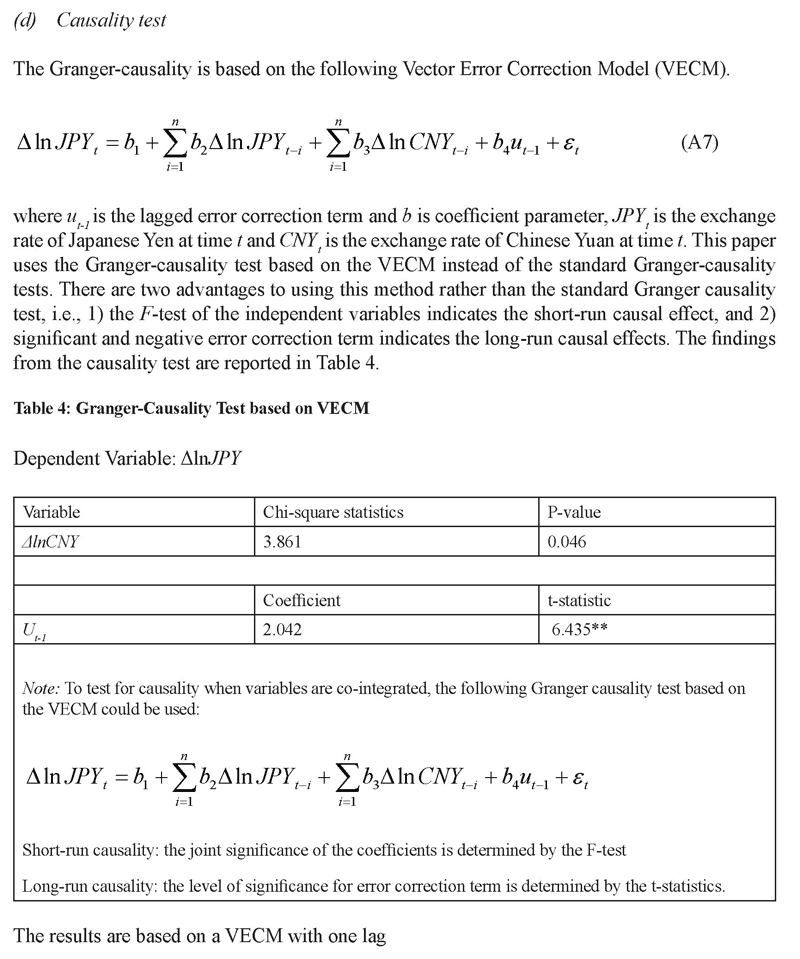

Finally, this paper examines the causal relationship between the Chinese Yuan and the Japanese yen by employing the Granger causality test (Engle & Granger, 1987). The empirical findings from the Granger causality test are reported in Table 4. The findings show that the error correction term is statistically significant and positive. This means that there is long-run Granger causality between the Chinese Yuan and Japanese Yen. In other words, the long-run Granger causality did confirm that there exists the long-run equilibrium relationship between two currencies. Moreover, as the results of the chi-square tests indicate, the Granger causality between the Chinese currency and the Japanese currency has been detected in the short-run. This means that the change in the exchange rate in the Chinese currency would influence Japanese currency.

In short, the most important and intriguing implication of this empirical analysis is that the Chinese Yuan plays a significant role of key currency to influence the movement of the Japanese Yen. In other words, the findings have provided empirical evidence that the Chinese currency could be considered as a regional key currency that would lead other regional momentary authorities to adopt the Chinese financial policy. These findings could be interpreted as the new pattern of the East Asian regionalism in which the regional momentary and financial coordination would become a main economic policy agenda.

The fundamental pattern of regional integration in East Asia is its hieratical structure. In other words, there has been a dominant economy that would lead remaining countries in the region, rather than more horizontal regional integration, such as the European Union, in which member countries are equal partner. From a historical perspective, there have been three attempts to integrate the East Asian countries. Before the Rise of China, Japan made two unsuccessful attempts to create East Asian regionalism before and after the Second World War.

The rise of China seems to signify a change of the leading economy in East Asia. More importantly, it can be seen as the formation of the China-led East Asian economic integration. This paper used several econometric methods to examine the possibility of the third flying geese in the East Asia. The empirical findings indicate that there is a long-run co-movement between the Chinese Yuan and the Japanese Yen. As a conclusion, the Chinese Yuan plays a central role as key currency to influence the movement of the Japanese Yen.

The most important policy implication is that the empirical findings confirmed that important role of currency in the regional integrations in East Asia. Since the European sovereign debt crisis broke out, the “European” approach, that introduced a new currency as key currency in the regional integration, came under strong criticism. Instead, East Asian countries’ monetary authorities seem to choose the Chinese Yuan as the de facto key currency which could be a relatively more effective and pragmatic choice for regional monetary integration.

The findings of this paper confirm the importance of China as the leading economy in East Asian economic integrations. For a future study, there is still a need to conduct further empirical analysis on the co-movement between national income, industrial productions, and inflation rates and other macroeconomic variable in order to examine the rise of China in the context of the East Asian regionalism. Furthermore, this paper focused on the hieratical structure of East Asian economic integration. The future may compare and contrast some similarities and differences between Asian and other regions’ regionalisms, such as the European Union (EU), the North American

Free Trade Agreement (NAFTA) and the Southern Common Market Treaty (MERCOSUR). Such comparative research would provide much-awaited insight and understanding of the intricate nature of regional integration in East Asia and beyond.

Akaike, H. (1974). A New Look at the Statistical Model Identification. IEEE Transaction on Automatic Control, 19, 716–723.

Akamatsu, K. (1935). Wagakuni yomo kogyohin no susei [Trend of Japanese Trade in Woollen Goods]. Shogyo Keizai Ronso [Journal of Nagoya Higher Commercial School] 13, 129–212.

Akamatsu, K. (1962). A historical pattern of economic growth in developing countries. Journal of Developing Economies, 1, 3–25.

Ahn, B. J. (2004). The rise of China and the future of East Asian integration. Asia-Pacific Review, 11, 18–35.

Aslam, M. (2009). Japan’s reluctance in the East Asian economic integration. Asia Europe Journal 7, 281–294.

Baldwin, R. (2008). Managing the noodle bowl: The fragility of East Asian regionalism. Singapore Economic Review, 53(3), 449–478.

Beeson, M. (2001). Japan and Southeast Asia: Lineament of Quasi-Hegemony. In Rodan, G., Hewison, K., & Robison, R. (Eds.), Political Economy of South-East Asia: An Introduction (pp. 283–306). Melbourne: Oxford University Press.

Buzan, B. (1988). Japan’s Future: Old History versus New Roles. International Affairs, 64(4), 557–573.

Calder, K. E. (1988). Japanese Foreign Economic Policy Formation: Explaining the Reactive State. World Politics, 40(4), 517–548.

Cohen, J. (1988). Statistical Power Analysis for the Behaviour Sciences, Hillsdale, N.J.; Lawrence Erlbaum Associates.

Dickey, D., and Fuller, W. (1979). Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74(366), 427–431.

The Economist. (2012). The rise of the Yuan: Turning from greet to red. The Economist dated on October 20, 2012. Retrieved November 18, 2012, from http://www.economist.com.

Engle R., & Granger, C. (1987). Co-integration and Error Correction: Representation, Estimation and Testing, Econometrica, 55(2), 251–276.

Fairclough, G. (1993). Standing Firm. Far Eastern Economic Review, 15 April 1993: 21.

Furuoka, F. (2002). Challenges for Japanese Diplomacy After the End of the Cold War. Contemporary Southeast Asia, 24(1), 68–81.

Hall, I. P. (1994/1995). Japan’s Asia Card. The National Interest, 38, 19–27.

Ikenberry, J. (2008). Rise of China and the Future of the West. Foreign Affairs, 87(1), 23–37.

International Monetary Fund. (2014). International Monetary Statistics. Retrieved February 16, 2014, from http://www.imf.org.

Jerden, B., & Hagstrom, L. (2012). Rethinking Japan’s China policy: Japan as accommodators in the rise of China, 1978-2011. Journal of East Asian Studies, 12, 215–250.

Johansen, S. (1988). Statistical Analysis of Cointegration Vector. Journal of Economic Dynamics and Control, 12(2/3), 231–254.

Johansen, S. (1991). Estimation and Hypothesis Testing of Cointegrated Vectors in Gaussian VAR Models. Econometrica, 59(6), 1551–1580.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration—with application to the demand for money. Oxford Bulletin of Economics and Statistics, 52, 169–210.

Katada, S. N. (2002). Japan’s Two-Track Aid Approach, The Forces Behind Competing Trends, Asian Survey, 42(2), 320–342.

Kuroyanagi, Y. (1995). Jinken Gaiko tai Eijian Uei [Human Rights Diplomacy and the Asian Way]. Kokusai Mondai, 422, 31–45.

Levi-Faur, D. (1997). List and the political economy of the nation-state. Review of International Political Economy, 4(1), 154–178.

Mahathir, M. (1988). New Government Policies. In K.S. Jomo (ed.), Mahathir’s Economic Policy (pp. 1–3). Kuala Lumpur: Insan, 1988.

Mearsheimer, J. (2006). China’s unpeaceful rise. Current History, 105, 160–162.

Miyashita, A. (1999). Gaiatsu and Japan’s Foreign Aid. Rethinking the Reactive-Proactive Debate. International Studies Quarterly, 43(4), 695–731.

Moody, P. R. (1996). Asian Values. Journal of International Affairs, 50(1), 166–192.

Onozawa, J. (1993). Japan and Malaysia: The EAEC Test of Commitment. Japan Quarterly, 40(3), 273–282.

Pempel, T. J. (1996/1997). Gulliver in Lilliput: Japan and Asian Economic Regionalism. World Policy Journal, 13(4), 13–26.

Peng, D. (2000). The Changing Nature of East Asia as an Economic Region. Pacific Affairs, 73(1), 171–191.

Saravanamuttu, J. (1988). The Look East Policy and Japanese Economic Penetration in Malaysia. In K.S. Jomo (ed.), Mahathir’s Economic Policy (pp. 4–28). Kuala Lumpur: Insan, 1988.

Tamamoto, M. (1991). Japan’s Uncertain Role. World Policy Journal, 8(4), 579–597.

Tay, S. (2002). Looking Beyond the Yasukuni Shrine Issue. Retrieved May 3, 2002, from http://www.asahi.com/English/asianet/column/eng_010921.html.

World Bank (1993). East Asian Miracle: Economic Growth and Public Policy. New York: Oxford University Press.

Zielinski, R. (1998). Role Model from Hell. Time, June 15, 1998.

Figures, Tables and Statistical Tests

(a) Co-movement of currencies in East Asia

(a) Pearson correlation test

The Pearson product-movement correlation coefficient can be calculated by:

Last Update: 24/12/2021