AEI-Insights - AN INTERNATIONAL JOURNAL OF ASIA-EUROPE RELATIONS

(ISSN: 2289-800X); JANUARY, 2017; Volume 3, Number 1

Fumitaka Furuoka

Asia-Europe Institute, University of Malaya, Malaysia

fumitaka@um.edu.my

This paper aims to conduct a comparative study and to examine whether Malaysia’s exports to its trade partner in Asia would be more beneficial than its counterpart in Europe. For this purpose, the current study examines Malaysia’s exports to Japan and Germany and their impacts on Malaysia’s economic development. The current study uses three types of econometric analysis, namely the unit root test, the co-integration test and the causality test. The empirical findings indicated three main points. Firstly, the ADF unit root test showed that income and exports are integrated of order one. In other words, these variables could be considered as stationary process at the first difference. Secondly, the EG test indicated that there would be no long-run relationship between income and exports from Malaysia to Japan. The co-integration test showed that there would be no long-run relationship between income and exports from Malaysia to Germany. Finally, the Granger causality test showed that there would be no causal relationship between income and exports from Malaysia to Japan. By contrast, the causality test indicated that there would be a causal relationship between exports from Malaysia to Germany and economic development in Malaysia.

Keywords

ASEAN regional integration, EU-ASEAN relationship, cross-border challenges, Asian financial crisis, avian influenza, Rohingya boat people, multi-level governance, institutional coordination

There is a debate among economists whether exports are beneficial to economic development. Proponents of exports stress the positive relationship between economic development and exports. There are four main advantages to focus on export led economic development. Firstly, export expansion induces exporting countries to focus on productions of goods and service in which these countries have a comparative advantage. Secondly, exports allow exporting countries to access the consumers on a global scale. Thirdly, export activities reduce the production costs in the exporting countries by improving production efficiencies and achieving a better allocation of available resources. Finally, export expansion allow exporting countries to increase imports of necessary intermediate goods and machineries, and better equipment (Balassa, 1978; Fosu, 1990). On the other hand, the opponents of exports stress the negative relationship between economic development and exports. These researchers asserted that exports create an unnecessary dependency of developing countries on developed economies. These theory is known as the dependency theory of international trade. According to this proposition, developing countries have become a provider of natural resources and market for the manufacturing goods produced by developed countries (Ram, 1985; Ram, 1987).

From a historical perspective, the “import-substitution industrialisation” (ISI) was a very popular development policy in the 1960s. However, the rapid industrialisation and high economic growth in Asian countries, such as Korea, Hong Kong, Taiwan and Singapore, offered an alternative and very successful approach, namely the “export-promotion industrialisation” (EPI) in the 1970s. Since then, many developing countries, including Malaysia, adopted the “export-led growth” strategy (Balassa, 1978; Bahmani-Oskooee and Alse, 1993; Ahmad and Harnhirun, 1996; Bahmani-Oskooee et. al., 2005). Despite its popularity among policymakers in developing countries, the export-development nexus was confirmed by empirical findings. In other words, researchers failed to produce a consistent empirical evidence to probe the validity of the export-led growth (ELG) hypothesis (Bahmani-Oskooee and Alse, 1993; Awokuse, 2003; Tang, Lai and Ozturk, 2015).

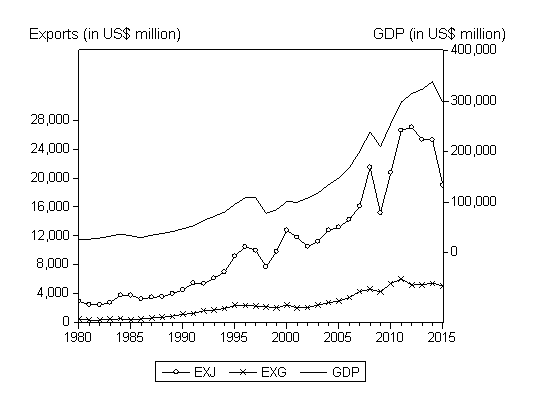

Against such backdrop, this paper chooses Malaysia as a case study to examine the export-development nexus for the period of 1980-2015. Particularly, this paper aims to conduct a comparative study and to examine whether Malaysia’s export to one of its major trading partners in Asia is more beneficial than a counterpart in Europe. For this purpose, the current study examines Malaysia’s exports to Japan and Germany and their impact on Malaysia’s economic development. It analyses the role of these countries’ trade with Malaysia in the process of economic development in Malaysia. The main justification to choose Japan and Germany is that these countries are major exporting countries in the world. Both countries are important trade partners with Malaysia and their exports to Malaysia have significant impact on the country’s economic development. For the purpose of the visual inspection, the total values of Malaysia’s exports to Japan (EXJ) and Germany (EXG) and Gross Domestic Product in Malaysia (GDP) is depicted in Figure 1. As the figure clearly indicates, there is a positive relationship among three variables. The total value of exports from Malaysia to Japan amounted to US$2.9 billion in 1980 and increased to US$4.5 billion in 1990, further to US$12.7 billion in 2000. On other hand, total value of exports from Malaysia to Germany amounted to US$0.4 billion in 1980 and increased to US$1.1 billion in 1990, further to US$2.4 billion in 2000. During the same period, the Gross Domestic Product (GDP) in Malaysia increased from US$26.3 billion in 1980 to US$47.2 billion in 1990, further to US$100.7 billion in 2000. Furthermore, the total value of exports from Malaysia to Japan amounted to US$13.1 billion in 2005 and increased to US$20.7 billion in 2010 and decreased to US$18.9 billion in 2015. By contrast, the total value of export from Japan to Germany increased from US$2.9 billion in 2005 and increased to US$5.4 billion in 2010 and decreased to US$5.0 billion in 2015. During the same period, the GDP in Malaysia increased from US$148.2 billion in 2005 to US$255.5 billion in 2010, further to US$297.0 billion in 2015 (Thomson Reuters, 2016).

Figure 1: Malaysia’s exports to Japan and Germany and economic development

Source: Thomson Reuters (2016)

Notes: EXJ denotes the total amount of exports from Malaysia to Japan, EXM denotes the total amount of exports from Malaysia to Germany, GDP denotes the Gross Domestic Product in Malaysia

This paper consists of five sections. Following this introductory section, the second section reviews briefly previous studies on the relationship between exports and economic development. The third section of this paper discusses data and research methods. The fourth section reports the empirical finding before the final section concludes this paper.

There is a wealth of literature on the relationship between exports and economic development since the 1940s. A pioneer analysis on the impact of exports on the economic development in the developing countries was published in the leading economics journal, Quarterly Journal of Economics (QJE) in 1947. Stolper (1947) pointed out that traditional trade theory assumed an income-generating effect of exports and an income-destructing effect of imports. Under these assumptions, the balanced growth of international trade would have no impact on the economic development because the positive effects of exports are offset by the negative effect of imports. However, Stolper (1947) asserted a balanced growth of trade could be beneficial when increase in trade would induce the higher domestic expenditure. Another pioneering study on the cyclical effects of exports was published in Quarterly Journal of Economics (QJE) in 1972. Blumenthal pointed out that the cyclical hypothesis of exports assumed stabilising effects of exports. Under this assumption, exports would increase in the economic downturn and exports would decrease in the economic boom. He empirically tested this hypothesis by choosing Japan for the period of 1951-1968 as the case study. Blumenthal asserted that there would be no statistically significant negative relationship between exports and income. However, he claimed that empirical findings do not offer any empirical evidence to prove the cyclical hypothesis of exports (Blumenthal, 1972).

In 1978, Balassa (1978) made a significant contribution to existing literature on the export-development nexus by testing the export-led growth (ELG) hypothesis. The ELG hypothesis made a bold assumption that the export-oriented industrialisation (EOI) policy promotes a better economic performance than the import-substitution industrialization (ISI) policy. Under this assumption, the EOI policy promotes a better allocation of resources according to the comparative advantage. Balassa (1978) empirically examined the export-development nexus in eleven developing countries for the period of 1960-1973. He concluded that there is a strong correlation between exports and economic development (Balassa, 1978). However, Ram (1985) claimed that there are some economists who stressed the negative effects of export expansion in the economic development in the developing countries. These researchers tend to view the trade as a tool to exploit developing countries. Ram (1985) examined the relationship between exports and economic development in seventy-three countries for the period of 1960-1977. He claimed that there is a positive non-significant relationship between exports and income in these countries (Ram, 1985). Another empirical study was conducted by Ram (1985). He asserted that the exports promote economic development in the developing countries by increasing the benefits of comparative advantage, providing a larger market for their products, achieving a higher level of utilisation and promoting technological innovation. He employed the ordinary least squares (OLS) method to examine the export-development nexus in eighty-eight countries for the period of 1960-1982. He concluded that exports are beneficial to economic development in these countries (Ram, 1987).

Since the 1990s, researchers applied the causality test to examine the export-development nexus in developing countries. For example, Dodaro (1993) pointed out that previous studies did not incorporate the causal analysis on the relationship between exports and economic development. Dodaro (1993) used the Granger causality test to examine the causal relationship between exports and economic development in eighty-seven countries for the period of 1967-1986. He concluded that there is a very weak empirical evidence to probe a causality between exports and economic development (Dodaro, 1993). On the other hand, Bahmani-Oskooee and Alse (1993) pointed out that previous studies of causal relationship between exports and economic development failed to produce consistent empirical findings. There are three main methodological problems in the aforementioned studies. Firstly, the previous studies did not pay attention to cointegrating relationship between exports and economic development. Secondly, the previous studies tended to ignore the nonstationary process of income and exports time-series. Thirdly, the previous studies faced a problem of the small number of observations. These researchers applied the error-correction model (ECM) method to examine the export-development nexus in the nine developing countries for the period of 1973-1988. They pointed out that there is bidirectional causality between exports and income in these nine developing countries (Bahmani-Oskooee and Alse, 1993). Furthermore, Kwan and Kwok (1995) applied the Granger causality test to examine the export-led development hypothesis in China for the period of 1952-1985. They pointed out that the linear regression analysis of the export-development nexus could not be used to examine the casual direction between exports and income. In the case that there would be bidirectional causality between exports and income, the findings from the linear regression analysis were not consistent. Kwan and Kwok (1995) pointed out that the Granger causality test rejected null hypothesis of no causality from exports to income. It means that their findings offer the empirical evidence to prove the export-led development industrialization strategy (Kwan and Kwok, 1995).

In the case of Malaysia, Ahmad and Harnhirun (1996) examined the relationship between exports and income in the five ASEAN countries, including Malaysia, for the period of 1966-1988. They pointed out that the successful story of rapid industrialisation of the Asian newly industrialising economies (NICs) induced other Asian countries, such as these ASEAN countries, to purse the export-oriented industrialisation policy. They claimed that some ASEAN countries successfully implemented industrialisation program and other countries were less successful. Ahmad and Harnhirun (1996) also applied the Granger causality test for their empirical analysis. The Granger test failed to reject the null hypothesis of no causality from exports to income while the causality test rejected the null hypothesis of reverse causality. This means that there is a unidirectional causality from income to exports, but not vice versa (Ahmad and Harnhirun, 1996). Moreover, Doraisami (1996) also examines the export-development nexus in Malaysia for the period of 1963-1993. The researcher suggested that Verdoorn’s law claims a positive association between productivity growth and output growth. In this context, the expansion of exports would contribute to economic development through productivity growths induced by an increase in the economy of scale. The researcher also commented that rubber and tin dominated more than two-third of Malaysia’s export in the 1960s. However, the Malaysian government introduced an attractive incentive for foreign investment in the 1980s and as a result manufactured goods dominated more than seventy percent of total exports in the 1990s. Doraisami (1996) used the Granger causality test to examine the export-development nexus in Malaysia for the period of 1963-1993. The Granger causality test rejected the null hypothesis of no causality from exports to income and the test also rejected the null hypothesis of reverse causality. The researcher concluded that there is a bidirectional causality between income and exports in the country (Doraisami, 1996).

In the 2000s, the empirical analysis of relationship between exports and economic development still remained a popular topic for research. Researchers applied more advanced econometric methods for their empirical analysis. For example, El-Sakka and Al-Mutairi (2000) used the Sims causality test and the Geweke causality test to examine the export-development nexus in sixteen Arab countries for the period of 1970-1999. They claimed the positive role of exports in the process of economic development can be expressed as a virtuous circle in the export-development nexus. The expansion of exports would induce exporting countries to discover their comparative advantage and it leads to the higher utilisation of resources and rapid economic growth. It would further realise economics of scale and it eases the exporting countries from foreign exchange constrains. In the end, this process improves the productivity of exporting countries. El-Sakka and Al-Mutairi (2000) pointed out that causality test produced a mixed result about the causal direction in the export-development nexus in these Arab countries (El-Sakka and Al-Mutairi, 2000). Moreover, Lee and Huang (2002) employed the threshold autoregressive method to examine the relationship between exports and economic development in the five Asian countries for the period of 1961-2000. They claimed that there are three main advantages of the export-oriented industrialisation policy. Firstly, export expansion would have positive impact on the growth of total productivity. Secondly, revenues from export activities would relax the foreign exchange constraint in the exporting countries. Thirdly, the export expansion would ensure to achieve the efficient price mechanism. They concluded that their findings offer empirical evidence to prove the validity of the export-led development (ELG) hypothesis (Lee and Huang, 2002). On the other hand, Awokuse (2003) claimed that the export-development nexus is one of the most important topics in the field of development economics. However, empirical analysis failed to produce consistent results whether the economic development is driven by exports or the export expansion is determined by the economic development. Awokuse (2003) applied the Toda-Yamamoto method to examine the relationship between exports and income in Canada for the period of 1961-2000. The researcher concluded that there is a statistical significant causality from exports to economic development. In other words, the empirical analysis offered empirical evidence to support the export-led development hypothesis (Awokuse, 2003).

Based on the panel data methods, Bahmani-Oskooee et al. (2005) examined the relationship between exports and economic development in sixty-one developing countries for the period of 1960-1999. They pointed out that the policymakers in developing countries are unable to decide whether their countries should adopt the “export-promotion” (PO) trade policy or the “import-substitution (IS) trade policy in order to achieve the high economic growth. If there would be a unidirectional causality from exports to economic development, the PO trade policy is appropriate policy. If there would be reverse causality, the IS trade policy is the better choice. They applied the Pedroni panel cointegration test for empirical analysis. The Pedroni test rejected null hypothesis of no cointegration for an estimation model with income as dependent variable. However, the Pedroni test failed to reject the null hypothesis for the estimation model with exports as dependent variable. In their particular case, looking at Canada, they concluded that there would be a unidirectional causality from exports to income (Bahmani-Oskooee et. al., 2005). On the other hand, Narayan et al. (2007) applied the bounds test for cointegration to examine the relationship between exports and economic development in Fiji and Papua New Guinea (PNG) for the period of 1960-2001. They claimed many developing countries pursued the “import-substitution” policy for their economic development. However, after the successful economic development of some Asian countries, such as Korea, Taiwan, Hong Kong and Singapore, developing countries decided to implement the export-oriented trade policy. In the case of Fiji, a bidirectional causality between exports and income in the long-run was identified. In PNG one the other hand, a bidirectional causality between exports and income in the short-run (Narayan et al., 2007). Bahmani-Oskooee and Economidou (2009) conducted another empirical analysis by using the Johansen cointegration test for the sixty-one countries for the period of 1960-1999. They claimed that export expansion would have positive impact on economic development through the multiplier effects of exports. In addition, the income expansion also has a positive impact on the export growth through cost reduction and actualisation of economies of scale. Their empirical findings are mixed and there is no uniform pattern in the export-development nexus in these developing countries (Bahmani-Oskooee and Economidou, 2009).

It should be noted that the export-development nexus is a popular topic until the present time. Researchers used the recently developed statistical method to examine the relationship between export and income in developing countries. For example, Tekin (2012) applied the Tony cointegration analysis to examine the export-development nexus in the eighteen least developed countries (LDCs) for the period of 1970-2009. The researcher argued that exports would have a multiplier effect on economic development by transferring resources from low-productivity industries to the high-productivity industry and increasing export revenues to purchase the necessary capital goods and machineries. Tekin (2012) highlights that empirical findings pointed towards an independent relationship between exports and income in these least developed countries (Tekin, 2012). On the other hand, Dreger and Herzer (2013) pointed out that there are four types of empirical analysis on the exports-development nexus. The first type of research used the correlation analysis to examine the topic and these studies found a positive association between exports and economic development. The second type of research used the causality test for their empirical analysis, however, these studies did not pay attention to cointergated relationship between exports and economic development. The third type of research applied cointegration test to examine a long-run relationship between exports and economic development. The fourth type of research applied the panel method for their empirical analysis. Dreger and Herzer (2013) claimed that there is bidirectional causality between exports and income in the short-run and there is also a unidirectional causality from exports to income in the long-run (Dreger and Herzer, 2013).

More recently, Tang et al. (2015) used the rolling-regression based Granger causality test to examine the relationship between exports and income in four Asian countries for the period of 1960-2007. They pointed out that the World Bank suggested “export-promotion” strategy as the best policy option for the developing countries. However, they claimed that the Asian economic crisis showed the danger of “over-dependence” to international trade. During the crisis, Asian countries tried to implement a new strategy, “domestic demand-led development” policy. If there would be presence of the unidirectional causality from exports to development, the policymakers in developing countries may adopt the “export-promotion” policy. If there would be independent relationship between exports and economic development, the “demand-led development” policy is a better option. The researchers claimed that the Toda-Yamamoto causality test indicates the presence of bidirectional causality between exports and income. However, they claimed that the rolling regression-based causality test showed the instability of causal relationship between variables (Tang et al., 2015). On the other hand, Konstantakopoulou (2016) used the Toda-Yamamoto method to examine the export-development nexus in the four European countries for the period of 1960-2014. The researcher pointed out that there is bidirectional causality between exports and income in four European countries. There is the presence of unidirectional causality from export to income in some countries and no causality in the remaining countries (Konstantakopoulou, 2016). Moreover, Shafiullah and Navaratnam (2016) commented that the newly emerging economies (NEEs) have achieved high economic growth through advancing the service sector, improvement in productivity and technological efficiency and human capital accumulation. The export expansion is considered as a key factor to promote the economic development in the developing countries. They used the autoregressive distributed lag (ARDL) method to examine the export-development nexus in Bangladesh and Sri Lanka for the period 1980-2011. They claimed that there is a bidirectional causality between exports and economic development in these two Asian countries (Shafiullah and Navaratnam, 2016).

Table 1: Summary of findings

| No | Authors (Year) | Countries | Number of years | Type of analysis | Findings |

|---|---|---|---|---|---|

| 1 | Blumenthal (1972) | Japan | 1953-1967 | Linear regression analysis | No significant relationship |

| 2 | Balassa (1978) | 11 developing countries | 1960-1973 | Linear regression analysis | Significant relationship |

| 3 | Ram (1985) | 73 developing countries | 1960-1970 and 1970-1977 | Linear regression analysis | No significant relationship |

| 4 | Ram (1987) | 88 developing countries | 1960-1982 | Linear regression analysis | Significant relationship |

| 5 | Fosu (1990) | 28 African countries | 1960-1980 | OLS method | Significant relationship |

| 6 | Dodaro (1993) | 87 developing countries | 1967-1986 | Granger causality test | No causality |

| 7 | Bahmani-Oskooee and Alse (1993) | 9 developing countries | 1973Q1-1988Q4 | Error correction model | Bidirectional causality |

| 8 | Kwan and Kwok (1995) | China | 1952-1985 | Granger causality test | Unidirectional causality from exports to income |

| 9 | Ahmad and Harnhirun (1996) | 5 ASEAN countries | 1966-1989 | Error correction model | Unidirectional causality from income to exports |

| 10 | Doraisami (1996) | Malaysia | 1963-1993 | Error correction model | Bidirectional causality |

| 11 | El-Sakka and Al-Mutairi (2000) | 16 Arabic countries | 1970-1999 | Granger, Sims, Geweke causality test | No causality between |

| 12 | Lee and Huang (2002) | 5 Asian countries | 1961Q1-2000Q1 | Threshold autoregressive method | Unidirectional causality from exports to income |

| 13 | Awokuse (2003) | Canada | 1961Q1-2000Q4 | Toda-Yamamoto test | Unidirectional causality from exports to income |

| 14 | Bahmani-Oskooee et. al.(2005) | 61 developing countries | 1960-1999 | Pedroni cointegration test | Long-run relationship |

| 15 | Narayan (2007) | Fiji and Papua New Guinea | 1960-2001 | Granger causality test | Unidirectional causality from exports to income |

| 16 | Bahmani-Oskooee et. al. (2009) | 61 developing countries | 1960-1999 | Johansen cointegration test | No general trend in the long-run relationship |

| 17 | Tekin (2012) | 18 developing countries | 1970-2009 | Konya causality test | No causality |

| 18 | Dreger and Herzer (2013) | 45 developing countries | 1971-2005 | Panel causality test | Short-run bidirectional causality |

| 19 | Tang et al. (2015) | 4 Asian countries | 1960Q1-2007Q2 | Rolling regression-based causality test | No consistent causality |

| 20 | Konstantakopoulou (2016) | 4 European countries | 1960-2014 | Toda-Yamamoto causality test | Bidirectional causality |

| 21 | Shafiullah and Navaratnam (2016) | Bangladesh Sri Lanka | 1950-2011 | Granger causality test | Bidirectional causality |

The current study aims to examine the relationship between Malaysia’s exports to Germany, Malaysia’s exports to Japan and Malaysia’s Gross Domestic Product (GDP) for the period of 1980-2015. It uses three sets of time-series data, namely the total value of exports from Malaysia to Germany (in US$ million), the total value of export from Malaysia to Japan (in US$ million) and Malaysia’s GDP. All data was obtained from Datastream (Thomson Reuters, 2016).

The current study will implement three stage of econometric analysis. In the first stage of empirical analysis, the augmented Dickey-Fuller (ADF) test is used to examine the stationary process of income and exports in Malaysia. The ADF test is based on the following equation (Dickey and Fuller, 1979):

where Δ is the difference operation, y is variable of interest, μ is intercept, β is slope coefficient and ε is error term. The null hypothesis of unit root process can be expressed as (Dickey and Fuller, 1979):

The alternative hypothesis can be expressed as (Dickey and Fuller, 1979);

If the ADF test would reject the null hypothesis of unit root, the variable of interest could be considered as the stationary process. In the second stage of empirical analysis, the Engle-Granger (EG) cointegration is used to examine the long-run relationship between income and exports in Malaysia. In the EG analysis, two different models are estimated. The first estimation model with yt as dependent variable is based on the following equation (Engle and Granger, 1987):

Furthermore, the second estimation model with xt as dependent variable is based on the following equation (Engle and Granger, 1987):

In the EG test, the ADF test is used to examine the stationary process of the estimated residuals from Equation (4) and Equation (5). If the ADF test rejects the null hypothesis of unit root, the dependent variable and the explanatory variable are cointegration. In other words, these variables have a long-run equilibrium relationship.

In the third stage of empirical analysis, the Granger causality test is used to examine the causal relationship between income and exports. In the Granger test, four different model are estimated. The first estimation model with GDPt as dependent variable and EXJt as explanatory variable is based on the following equation (Granger, 1969):

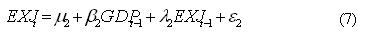

The null hypothesis of no causality from EXJt to GDPt can be tested by the statistical significant in the slope coefficient for the EXJt-1 in Equation (6). In other words, if the slope coefficient, β1 is not zero, it would mean that there is causality from EXJt to GDPt. Similarly, the second estimation model with EXJt as dependent variable and GDPt as explanatory variable is based on the following equation (Granger, 1969):

The null hypothesis of no causality from GDPt to EXJt can be tested by the statistical significant of β2 in the Equation (7). Furthermore, the third estimation model with GDPt as dependent variable and EXGt as explanatory variable is based on the following equation (Granger, 1969):

The null hypothesis of no causality from EXGt to GDPt can be tested by the statistical significant of β3 in the Equation (8). Finally, the fourth estimation model with EXJt as dependent variable and GDPt as explanatory variable is based on (Granger, 1969):

The null hypothesis of no causality from GDPt to EXJt can be tested by the statistical significant of β4 in the Equation (9).

In the current study, three stages of empirical analysis are implemented in order to examine the relationship between exports and economic development in Malaysia. In the first stage of empirical analysis, the augmented Dickey-Fuller test is used to examine the unit root process of time series data (Dickey and Fuller, 1979). The empirical findings from the ADF test are reported in Table 2. As the findings in the table indicate, the ADF test failed to reject the null hypothesis of unit root in GDP and the ADF test rejected the null hypothesis of unit root in ΔGDP. This means that the time series data on income in Malaysia can be considered as unit root process at level and the stationary process at the first difference. In other words, the income time series can be integrated of order one, I(1). Similarly, the ADF test also failed to reject the null hypothesis of unit root in EXJ and the ADF test rejected the null hypothesis of unit root in ΔEXJ. It means that the time series data on exports from Malaysia to Japan can be considered as unit root process at level and the stationary process at the first difference. This finding shows that the export time series also can be integrated of order one, I(1). Moreover, the unit root test failed to reject the null hypothesis of unit root in EXG and the test could reject the null hypothesis of unit root in ΔEXG. This finding indicates that the time series data on exports from Malaysia to Germany can be considered as unit root process at level and the stationary process at the first difference. This findings implies that the export time series also can be integrated of order one, I(1).

Table 2: Empirical findings from the unit root test

| Variables | Intercept | Intercept and trend |

|---|---|---|

| GDP | 0.362 | -1.664 |

| ΔGDP | -3.524** | -3.692** |

| EXJ | -0.804 | -2.741 |

| ΔEXJ | -4.667*** | -4.794*** |

| EXG | -0.327 | -2.244 |

| ΔEXG | -5.257*** | -5.181*** |

Notes: ** indicates the significant level at the 5 percent;

*** indicates the significant level at the 1 percent

In a second stage of empirical analysis, the Engle-Granger (EG) cointegration test is used to examine the long-run relationship between income and exports in Malaysia (Engle and Granger, 1987). The empirical findings from the EG test are reported in Table 3. As the empirical findings in the table indicated, the EG test failed to reject the null hypothesis of no cointegration relationship between GDP and EXJ. This means that there would be no long-run relationship between income and the exports from Malaysia and Japan. Similarly, the EG test failed to reject the null hypothesis of no cointegration between GDP and EXG. It shows that there would also be no long-run relationship between income and the exports from Malaysia to Germany.

Table 3: Empirical findings from the co-integration test

| Estimation model with GDP as dependent variable and EXJ as explanatory variable | Estimation model with EXP as dependent variable and EXG as explanatory variable |

|---|---|

| -2.124 | -1.730 |

In the final stage of empirical analysis, the Granger causality test is used to examine the causal relationship between income and exports in Malaysia (Granger, 1969). The empirical findings from the Granger test are reported in Table 4. As the empirical findings in the table clearly indicate, the Granger test failed to reject the null hypothesis of no causality from EXJ to GDP. It means that the exports from Malaysia to Japan would not cause economic development in Malaysia. Similarly, the Granger causality test also failed to reject the null hypothesis of no causality from GDP to EXJ. This means that the economic development in Malaysia would not cause the expansion of exports from Malaysia to Japan. On the other hand, the Granger causality test was able to reject the hypothesis of no causality from EXG to GDP. This finding showed that the exports from Malaysia to Germany would cause economic development in Malaysia. Moreover, the Granger causality test failed to reject the null hypothesis of reverse causality. It shows that there is no causality between economic development in Malaysia and exports from Malaysia to Germany.

Table 4: Empirical findings from the causality test

| Exports to Japan (EXJ) would cause economic development (GDP) | Economic development (GDP) would cause exports to Japan (EXJ) |

|---|---|

| 0.151 | 0.887 |

| Exports to Germany (EXG) would cause economic development (GDP) | Economic development (GDP) would cause exports to Germany (EXG) |

| 9.155*** | 0.807 |

Notes: *** indicates the significant level at the 1 percent;

In short, empirical analysis indicated three main points. Firstly, the ADF unit root test indicated that income and exports are integrated of order one. In other words, these variables could be considered as stationary process at the first difference. Secondly, the EG test indicated that there is no long-run relationship between income and exports from Malaysia to Japan. The cointegration test also showed that there is no long-run relationship between income and exports from Malaysia to Germany. Finally, the Granger causality test showed that there is no causal relationship between income and exports from Malaysia to Japan. The causality test indicated that there is unidirectional causality from exports from Malaysia to Germany.

This paper conducted a comparative study and examined the roles of Malaysia’s exports to Asia and Europe in the process of economic development. In other words, it examined the exports from Malaysia to Japan and Germany and their impact on economic development in Malaysia. For the purpose of empirical analysis, this study implemented the three stage of empirical analysis. In the first stage of empirical analysis, the ADF unit root test is used to examine the unit root process of income and exports in Malaysia. The unit root test indicated that both income and exports could be considered as the stationary process in the first differences. In the second stage of empirical analysis, the EG cointegration test was used to examine the long-run relationship between exports and income in Malaysia. The cointegration test showed that there would be no long-run relationship between income and exports in the country. In the third stage of empirical analysis, the Granger causality test is used to examine the causal relationship between income and exports. The causality test implied that there was no causality between exports from Malaysia to Japan and economic development. By contrast, the causality test also indicated that there was a causality between Malaysia’ exports to Germany and economic development in Malaysia.

As a conclusion, the empirical findings clearly indicate that Malaysia’s exports to its trade partner in Europe is more beneficial to economic development in Malaysia, than Malaysia’s exports to the counterpart in Asia. This fact may imply that Malaysia’s trade relationship with a European country could be more beneficial to its economic development, than its trade relationship with an Asian country. In other words, Malaysia’s economic ties with Europe could be as important as its economic ties with Asian countries.

There are two main policy implications. Firstly, policymakers should be aware of the fact that there would be no causal relationship between Malaysia’s trade with Japan and economic development in Malaysia. In other words, despite its dominant position in Malaysia’s external economic relations, Japan does not seem to contribute to Malaysia’s economic development from a perspective of international trade. Secondly, policymakers should be aware of another important fact that there would be a unidirectional causality between Malaysia’s exports to Germany and economic development in Malaysia. In other words, despite its relatively minor position in Malaysia’s external relationship, Germany seems to contribution to Malaysia’s economic development from a perspective of international trade.

The current study used the three-stage empirical analysis to examine the relationship between income and exports in Malaysia. A similar study can be conducted to examine the export-development nexus in other Asian countries, such as India, Indonesia, Thailand, Singapore and so on. The future studies can use longer time series data and more advanced statistical methods for the empirical analysis. Findings from such study would offer an interesting insights on the export-development nexus in Malaysia.

Ahmad, J., & Harnhirun, S. (1996). Cointegration and Causality between Exports and Economic Growth: Evidence from the ASEAN Countries, Canadian Journal of Economics, 29, S413–S416.

Awokuse, T.O. (2003). Is the Export-Led Growth Hypothesis Valid for Canada?, Canadian Journal of Economics, 36(1), 126–136.

Bahmani-Oskooee, M., & Alse, J. (1993). Export Growth and Economic Growth: An Application of Cointegration and Error-Correction Modelling. Journal of Developing Areas, 27(4), 535–542.

Bahmani-Oskooee, M., Economidou, C., & Goswami, G.G. (2005). Export led growth hypothesis revisited: A panel cointegration approach. Scientific Journal of Administrative Development, 3, 40–55.

Bahmani-Oskooee, M., & Economidou, C. (2009). Export Led Growth vs. Growth Led Exports: LDCs Experience. Journal of Developing Areas, 42(2), 179–209.

Balassa, B. (1978). Exports and Economic Growth: Further Evidence. Journal of Development Economics, 5, 181–89.

Blumenthal, T. (1972). Exports and Economic Growth: The Case of Post-war Japan. Quarterly Journal of Economics, 86(4), 617–631.

Doraisami, A. (1996). Export Growth and Economic Growth: A Re-examination of Some Time-Series Evidence of the Malaysian. Journal of Developing Areas, 30(2), 223–230.

Dickey, D.A., & Fuller, W.A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427–431.

Dodaro, S. (1993). Exports and Growth: A Reconsideration of Causality. Journal of Developing Areas, 27, 227–244.

Dreger, C., & Herzer, D. (2013). A further examination of the export-led growth hypothesis. Empirical Economics, 45:39–60.

Engle, R.F. & Granger, C.W.J. (1987). Cointegration and error correction: Representation, estimation and testing. Econometrica, 55, 251–276.

El-Sakka, M.I., & Al-Mutairi, N.H. (2000). Exports and Economic Growth: The Arab Experience. Pakistan Development Review, 39(2), 153–169.

Fosu, A.K. (1990). Exports and Economic Growth: The African Case. World Development, 18(6), 831–835.

Granger, C.W.J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37, 424–438.

Konstantakopoulou, I. (2016). New evidence on the Export-led-growth hypothesis in the Southern Euro-zone countries (1960-2014). Economics Bulletin, 36(1), 429–439.

Kwan, A.C.C., & Kwok, B. (1995). Exogeneity and the Export-Led Growth Hypothesis: The Case of China. Southern Economic Journal, 61(4), 1158–1166.

Lee, C.H., & Huang, B.N. (2002). The Relationship between Exports and Economic Growth in East Asian Countries: A Multivariate Threshold Autoregressive Approach. Journal of Economic Development, 27(2), 45–68.

Narayan, P.N., Narayan, S., Prasad, B.C., & Prasad, A. (2007). Export-led growth hypothesis: evidence from Papua New Guinea and Fiji. Journal of Economic Studies, 34(4), 341–351.

Ram, R. (1985). Exports and Economic Growth: Some Additional Evidence. Economic Development and Cultural Change, 33(2), 415–425.

Ram, R. (1987). Exports and Economic Growth in Developing Countries: Evidence from Time-Series and Cross-Section, Economic Development and Cultural Change, 36(1), 51–72.

Shafiullah, M., & Navaratnam, R. (2016). Do Bangladesh and Sri Lanka Enjoy Export-Led Growth? A Comparison of Two Small South Asian Economies. South Asia Economic Journal, 17(1), 114–132.

Stolper, W.F. (1947). Volume of Foreign Trade and the Level of Income. Quarterly Journal of Economics, 61(2), 285–310.

Tang, C.F., Lai, Y.W., & Ozturk, I. (2015). How stable is the export-led growth hypothesis? Evidence from Asia's Four Little Dragons. Economic Modelling, 44, 229–235.

Tekin, R.T. (2012). Economic growth, exports and foreign direct investment in Least Developed Countries: A panel Granger causality analysis. Economic Modelling, 29, 868–878.

Thomson Reuters (2016). Datastream. http://thomsonreuters.com/en.html [accessed on 16 February 2016].

Last Update: 24/12/2021